Whether you’re a HR manager or a newly-minted business owner, running a company comes with a lot of administrative work. Ensuring proper payroll practices and bookkeeping are time-consuming but crucial aspects that’ll keep your employees happy and your business compliant with the law.

Beyond keeping detailed receipts of all your company’s employment and salary records, you can’t simply ping your staff a PayNow transfer. The Ministry of Manpower (MOM) requires all companies to issue their employees itemised payslips within 3 days of payday. This means that the bigger your company, the more paperwork you’ll have to do.

The good news is that there’re payroll software tools and HR solutions in the market out there for Singapore companies to ensure that salaries go out on time and compensation is done by MOM guidelines.

You won’t have to be a tech guru to set up a payroll system, as many are designed to work with Singapore labour laws. Streamline your back-office processes and make your pay cycle a breeze with these payroll tools made for local organisations.

We’ve also included a rate comparison table at the end to suss out the most value-for-money option.

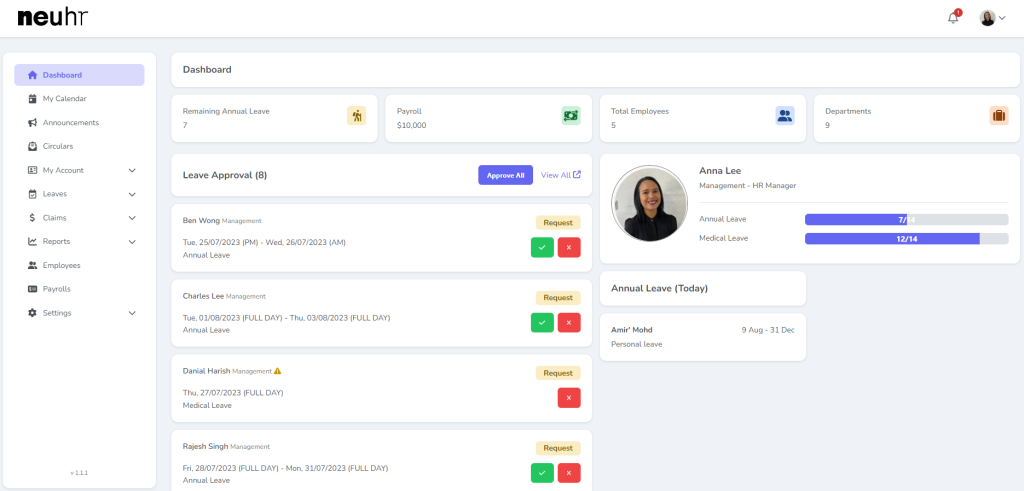

1. NeuHR – affordable payroll & leave management system for Singapore firms

Image credit: NeuHR

If work efficiency is your top priority and you hate having a hundred open tabs just to settle administrative matters, then NeuHR is the HR solution you need on your radar. With a user-friendly layout and easy navigation from payroll to leave and claims approval to employee listings, NeuHR will let you see everything to do with your team’s salaries in one interface.

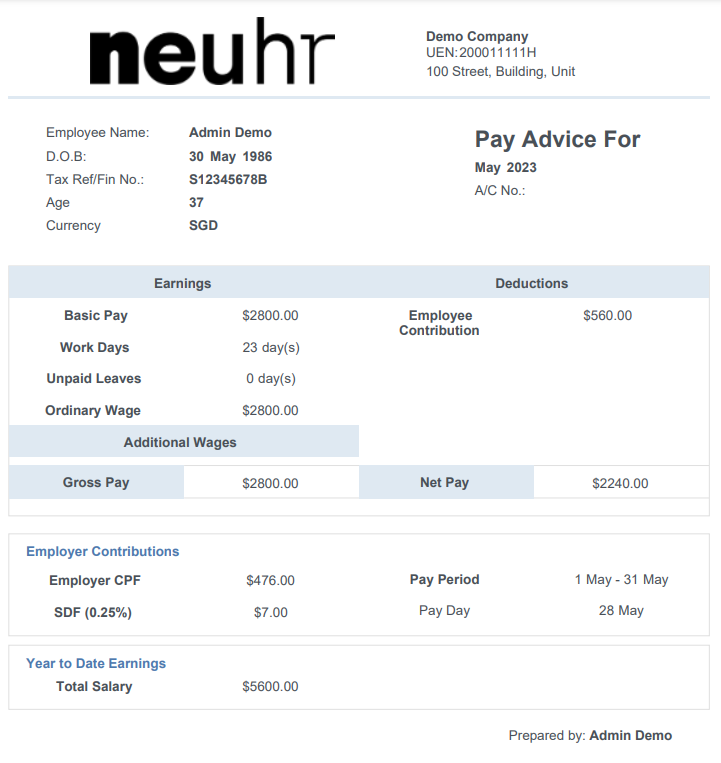

No more punching calculator buttons to tabulate salaries based on leave allowance and Singapore public holidays. NeuHR automatically factors these into your staff’s itemised payslips, on top of CPF and bonus information – all stored online.

How an itemised pay slip looks like on NeuHR.

Image credit: NeuHR

NeuHR also provides an organisational chart where you can show everyone who belongs to which team, the uploading of companywide announcements to ensure that staff are up to speed on everything that is going on, and fast expense claim submission and approval.

Start-ups will be glad to note that NeuHR is free monthly for companies with no more than 20 employees, including company-wide announcements, payroll, and leave tracking features.

Mid-sized companies with up to 50 staff can subscribe for $49/month, which works out to just $0.98/month per employee. This includes additional company circulars, reporting, online claim functions, and company logo use for payslips.

For larger companies, fees start from $199 for up to 200 staff or $299 for up to 300 staff.

Find out more about NeuHR.

2. Talenox – efficient in-app customer support

Talenox is well-integrated with local banks and IRAS.

Image credit: Talenox

Talenox is a payroll and HR system designed for companies with a presence in Singapore, Hong Kong, and Malaysia.

For Singapore companies, its payroll tool can accommodate weekly, monthly, or contract-based payment schedules.

With a slew of Singapore-recognised leave settings – from annual to maternity and paternity to reservist to outpatient and sick leave, and paid and unpaid vacation days – your staff won’t have to run to you to make sure their applications go through.

Talenox is also good for SMEs with an overseas bases; with their multi-payroll system, it keeps track of Hong Hong’s Employment Ordinance and Malaysia’s employment regulations. And if you ever have questions, Talenox provides efficient in-app customer support.

Talenox has a 30-day trial, and plans start from $43.20/month for first five employees only. Additional charges of $8.64 apply for additional employees.

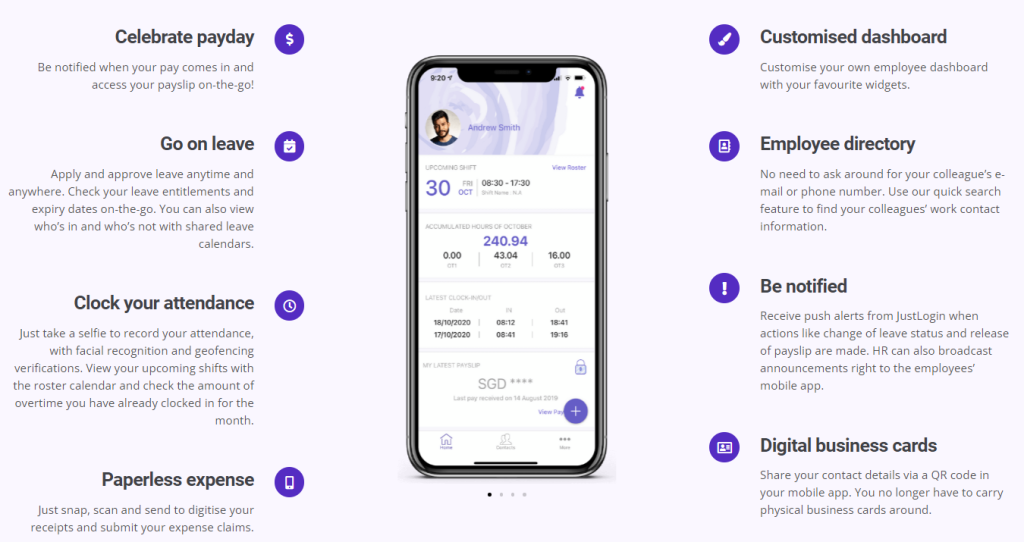

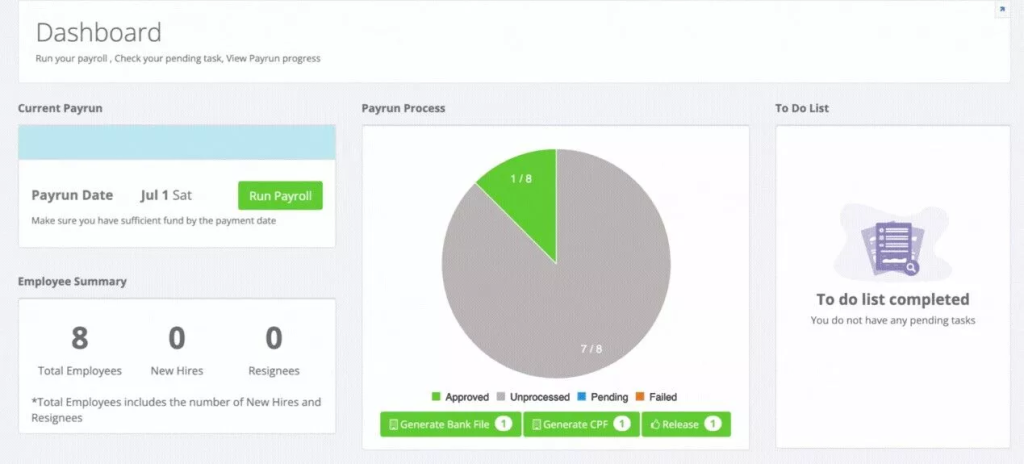

3. JustLogin – pre-approved by government grant providers

Image credit: JustLogin

For very new start-ups and SMEs, the idea of whipping out a lot of money to automate your business can be daunting. As part of the SMEs Go Digital Programme by IMDA, JustLogin lets you easily qualify for grants such as the productivity solutions grant (PSG) from IMDA, as it’s a pre-approved digital solution.

Image credit: JustLogin

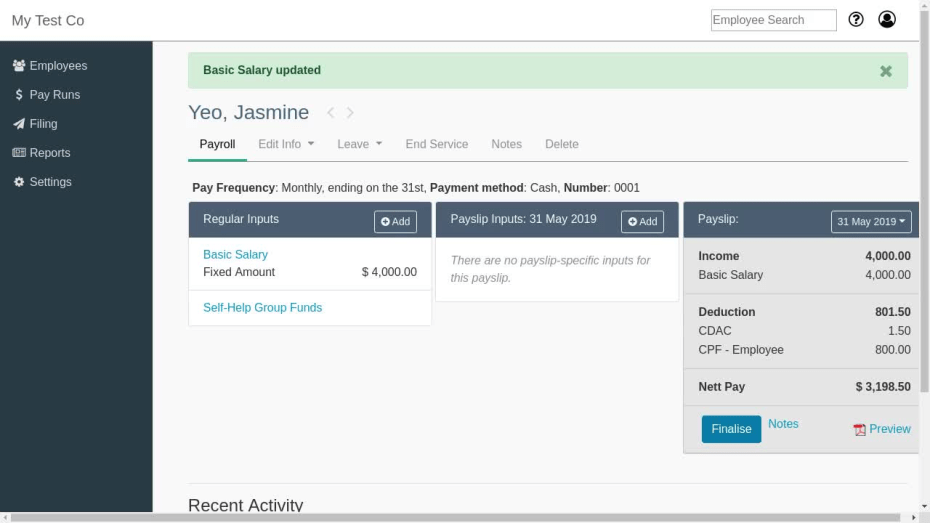

JustLogin is able to do the nitty-gritty – it can factor in overtime bonuses in your payslips, settle everything from allowances to reimbursements, and even calculate your CPF contributions.

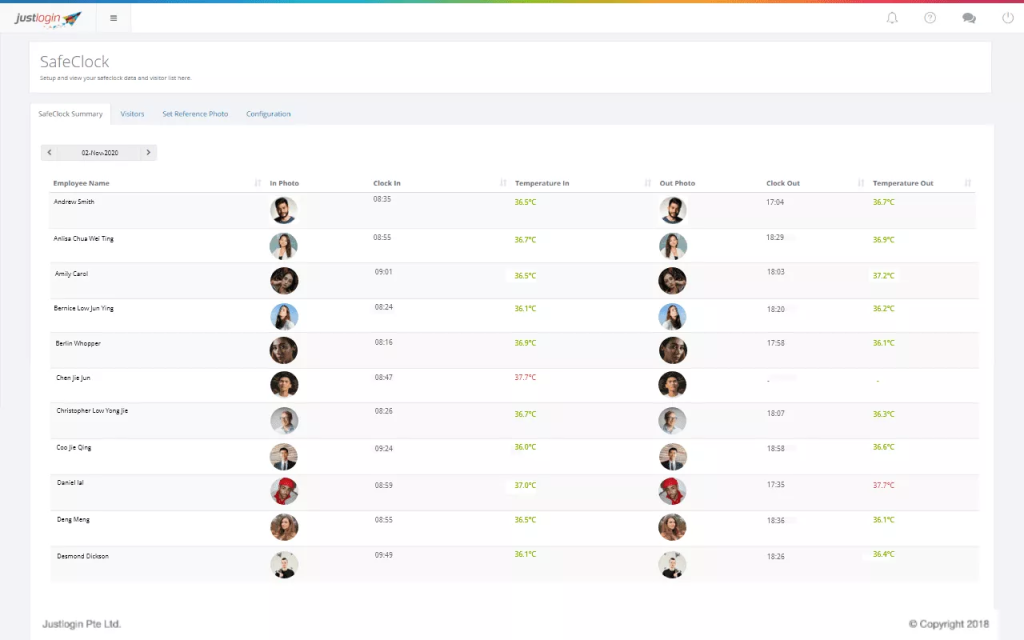

Image credit: JustLogin

SafeClock also lets you track employee work hours and even forehead temperatures by having them take a selfie as they clock in and out of work, giving you an overarching view of their attendance record.

Prices are upon enquiry.

4. SimplePay – automatic updates to comply with CPF and IRAS guidelines

Image credit: SimplePay

Owning a startup gives you the chance to establish your company’s procedures the way you like, yet it also means tackling many new tasks for the first time. SimplePay‘s payroll system caters to this situation, assuming it’s your debut attempt handling payroll and tax compliance.

SimplePay guides you through CPF and statutory contributions, and automatically updates its calculations according to IRAS and CPF guideline updates as they happen – such as the gradual increase of the CPF ordinary wage ceiling from 1st September 2023 to 1st January 2026.

On top of accurate payroll processing, you get to effortlessly manage company events and celebrations on a company calendar, monitor employees’ leave days, and simplify tax e-filing under IRAS’ auto-inclusion scheme.

No installations are needed – so you can access your data online from anywhere, freeing you from carrying a HR laptop around.

Prices start at $4 per employee per month if you have under 25 employees. If your company exceeds this headcount, the price goes to $3 per employee.

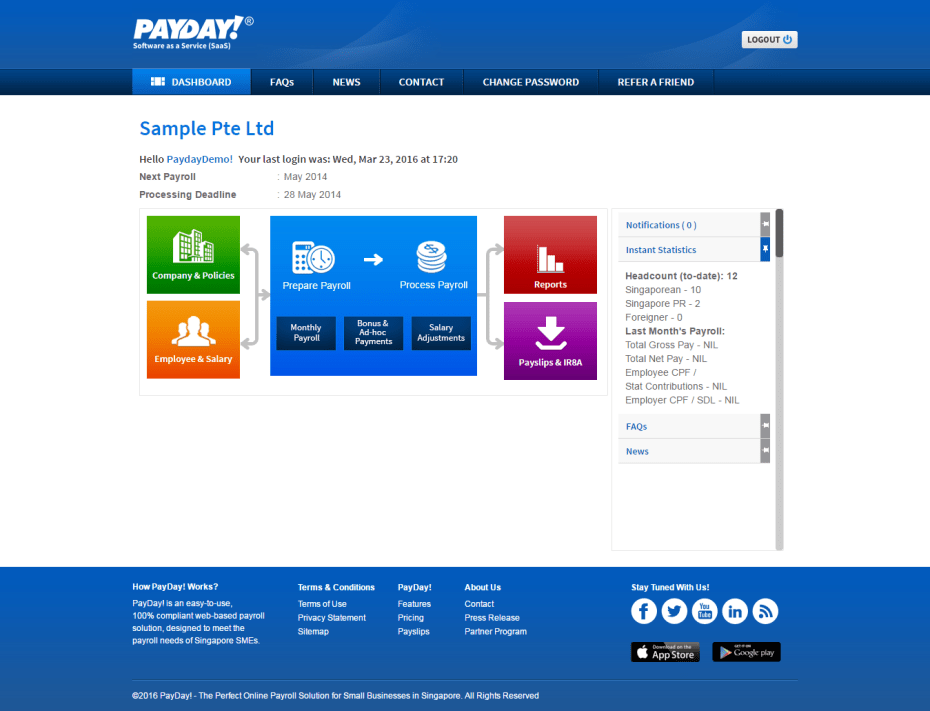

5. PayDay – Includes work pass management

Image credit: PayDay

You can trust accountants and tax service providers to know Singapore payroll laws best – and it’s the payroll and HR admin services division of auditing firm RSM, PayrollServe, that has come up with PayDay! SaaS, an online payroll tool.

With experience advising Singapore companies of all sizes, PayDay! understands how to calculate salaries of those on various kinds of Singapore work passes and permits. And if you have more complex HR needs, the Singapore-based PayrollServe team is available for consultations.

Other HR services PayDay provides include HR consultancy, where they have management specialists on board that can help you out with trickier decisions for your company.

Pricing starts at $25 a month for teams of 1-5 employees.

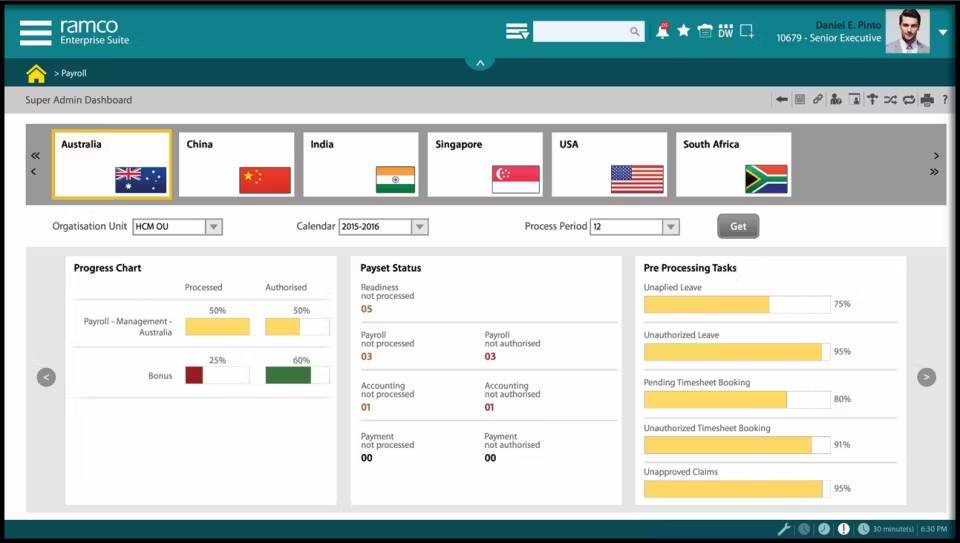

6. Ramco – Manages digital assets extensively

Image credit: Ramco and Softwareadvice.com.sg

Truly multinational companies will want to avoid the whiplash of switching between different HR tools for different regions or keeping up with changing country guidelines.

Ramco is aligned with over 150 countries’ laws, with a strong presence in APAC, the Middle Eastern and African regions, Australia and NZ, the UK, Ireland, and the USA. This way, your headquarters’ HR team can get a clear view of payroll disbursal and employee time and attendance tracking.

And if you need more from Ramco, it provides enterprise asset and supply chain management for companies involved in logistics and shipping, and even fleet management and maintenance tracking for aircraft.

Rate comparison of payroll software and tools for Singapore companies

| Platform | NeuHR | Talenox | SimplePay | PayDay! | JustLogin | Ramco |

| Monthly cost | 20 and fewer staff: Free Up to 50 staff: $49/month Up to 200 staff: $199/month Up to 300 staff: $299/month |

First 5 staff: $43.20/month $8.64 for each additional person |

First 25 staff: $4 per person/month Above 25 staff: $3/per person/month |

First 5 staff: $25/month | Price upon enquiry | Price upon enquiry |

| USPs | Most affordable for teams of 0-300 | Good for businesses with bases in HK and Malaysia | For automatic CPF/tax law updates | Most affordable for teams of 1-5 staff | Pre-qualified by IMDA for easy grant application | Most comprehensive features |

Payroll tools and software for Singapore companies that are MoM-compliant

To make your HR tasks seamless, opt for tools tailored for the Singapore context – such as one that recognises Singapore public holidays and CPF rates without you having to perform these calculations for every single employee.

With NeuHR, say goodbye to manually typing out itemised payslips, calculating CPF deductions, and pro-rating salaries with a payroll software tool used by fellow Singaporean organisations.

Understandably, transitioning to a new payroll system requires a trial period so that you can explore how it aligns with your current work processes. That’s why NeuHR offers a product demo and is even free (as a monthly subscription, not a limited time trial) for under 20 employees.

It can also accommodate businesses of various sizes, making it accessible to both SMEs and larger enterprises. To get started on simplifying your payroll management, reach out to [email protected] to find out how it can support your HR needs.